Sanjay Pasari director of Banco Consultant says “Globally, there is a lot of evidence that ESG strategies perform better when risk is taken into account.” According to his words, it is clear that he is very geeked with the ESG policy rolled out by SEBI and solicits people to adopt ESG as soon as possible within the organization to boost productivity. As per Sanjay Pasari, “middleman provide valuable feedback to the producers about their market offering in addition to constantly matching the supply and demand in the market. Some legitimate middlemen are good and essential for the finance sector but some practices of middlemen in the finance sector are harmful to investors and investees. Implementing ESG strengthens the organization and offers it a big leap to build a devoted company from the ground up”.

Adopting ESG within an organization fosters a digital infusion that perpetuates illicit practices. The bottom line is a very fair rationale: Sustainable business practices and environmentally sound practices are essential for long-term success. Adopting it in a positive way can lead to companies responding by incorporating such factors into their operations as investors become more interested in ESG.

In the same vein, Sanjay Pasari raises questions about the delay in implementation. There is ample evidence globally that ESG strategies are better when risk is considered. Pension funds and sovereign wealth funds, two major institutional investors, have recently embraced ESG within society. This momentum will continue to increase as the costs of climate change become harder and harder to ignore. Many organizations have already broken their ties with fossil fuels and are starting to embrace sustainable energy.

In order to reduce operational impacts and improve biodiversity, the Asian Paints NEW (N-Natural Resource Conservation, E-Energy and Emission Reduction and W-Waste Reduction) project focuses on environmentally friendly production facilities and activities. It is now the largest player in the paint and varnish industry, accounting for about 35% (majority) of the market share.

Scholarships are awarded by Maruti Suzuki to deserving students from poor and vulnerable communities. Apart from adopting several Industrial Training Institutes (ITIs) in collaboration with multiple states, Maruti Suzuki also established the first Japan-India Institute of Manufacturing (JIM) in Gujarat.

According to a recent survey by Deloitte Global and Forbes Insights, adopting strong ESG principles improved respondents' ability to attract and retain talent by 38% and led to a 48% increase in customer satisfaction.

By integrating ESG with the financial sector, all stakeholders will be considered in the decision-making process, which has a positive real-world impact on all parties. This particular article discusses the evolving financial landscape from an ESG perspective. It analyzes the elements that require consideration of ESG issues in the research and investment process for all stakeholder groups, from investors to asset managers. The time has come to take steps to strengthen the system's resilience as we enter the final decade of work to achieve the Sustainable Development Goals.

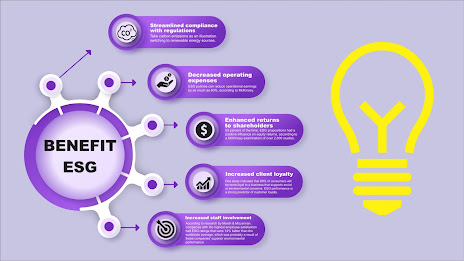

Pasari also explained the benefits of adopting ESG within organizations “the need for companies to make sustainable decisions is growing. To reduce and improve the operational impact of biodiversity, companies will take steps to separate growth from their ecological footprint and focus on environmentally friendly processes, production facilities and products. It is no wonder that investors and regulators are focused on evaluating companies that use an ESG framework and sustainable business practices. "In light of India's recent commitment to achieve non-zero carbon emissions by 2070 at the COP 26 summit, companies must practice ESG."

As financial expert Sanjay Pasari said, "We need to address climate change along with line-value principles. The importance of incorporating ESG factors into investment analysis will only increase if we start doing it as soon as possible." To protect our environment and maintain a balance between cultural and ordinary activity, we cannot do anything but ESG. We owe it to our motherland because future generations depend on us. "

Comments

Post a Comment